Income Tax Return (ITR)

Introduction

In the ever-evolving landscape of personal finance, one term that resonates with every earning individual is "Income Tax Return" or ITR. This comprehensive guide aims to demystify the intricate world of ITR, providing you with a clear understanding of what it is, why it's essential, how to file it, and common FAQs surrounding the topic.

What is ITR?

Income Tax Return, abbreviated as ITR, is a mandatory document that every taxpayer needs to file with the government. It serves as a record of your income, tax liabilities, deductions, and exemptions for a specific financial year. Essentially, it's a way for the government to assess your income and ensure that you're paying the correct amount of taxes.

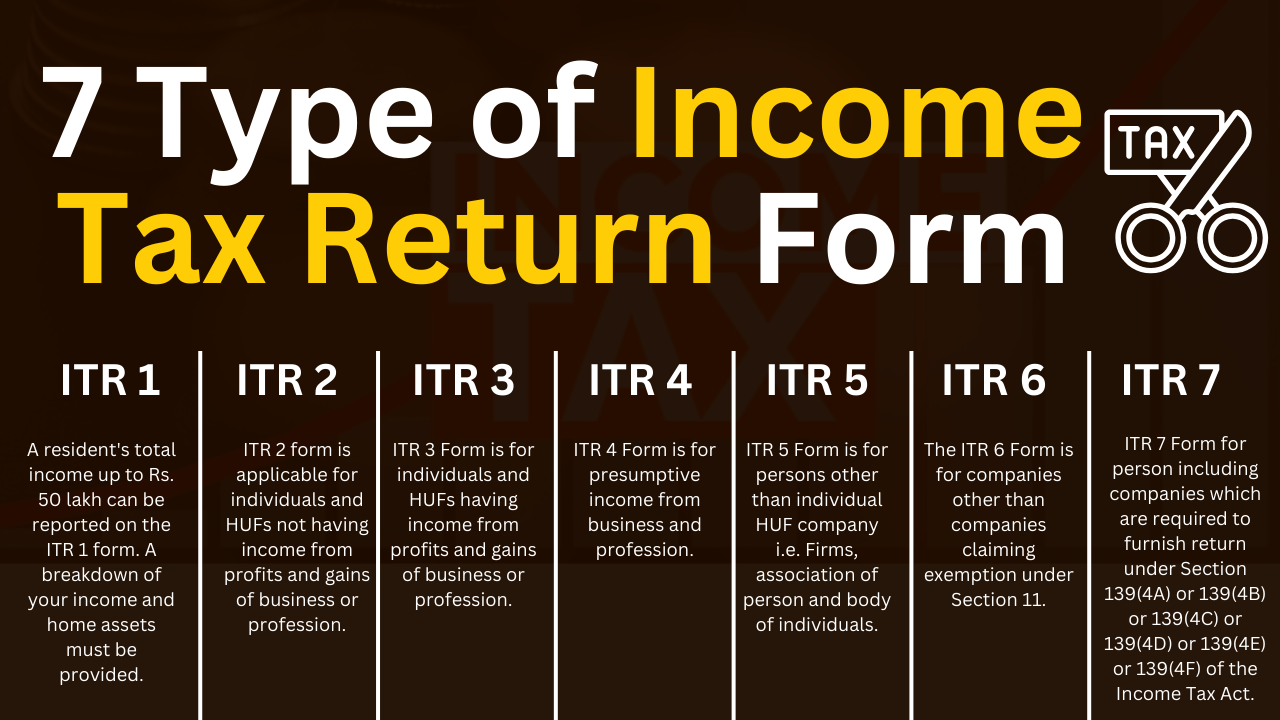

Types of ITR Forms

There are various types of ITR forms, each catering to different categories of taxpayers, such as individuals, businesses, and corporations. The most common ones include:

ITR-1

- Appropriate for wage earners and retirees.

- Salary, rental income from a single home, and other sources of income Total

- A combined income of up to 50 lakhs.

ITR-2

- Income from multiple properties, capital gains, and foreign assets.

- Total income exceeding ₹50 lakhs.

- Open to both private parties and Hindu undivided families (HUFs).

ITR-3

- Designed for business owners and professionals with income from the partnership firm.

- Income from business and profession.

- Must be filed by taxpayers under the presumptive taxation scheme.

Why is ITR Important?

Legal Requirement

An ITR must be filed by law, not only on a voluntary basis. Penalties and legal repercussions may ensue from failure to comply. To keep yourself out of avoidable legal difficulty, it's imperative to fulfill your tax duties.

Financial Proof

Your ITR serves as financial proof when you need to apply for loans, visas, or even for buying insurance policies. Lenders and institutions often require your ITR as a document to evaluate your financial stability.

How to File ITR

Gather Your Documents

Before you begin, ensure you have all the necessary documents such as your PAN card, Aadhar card, Form 16 (provided by your employer), and other income-related documents.

Choose the Correct ITR Form

Depending on your income sources and financial position, choose the appropriate ITR form. Using the incorrect form can result in errors and delays.

Online or Offline?

You can file your ITR both online and offline. Online filing is the most convenient and efficient way, as it offers a quicker processing time and reduces the chances of errors.

Calculate Your Taxable Income

Carefully calculate your taxable income, taking into account all deductions and exemptions you are eligible for.

Fill in the Details

Provide accurate information in your ITR form, including income details, deductions, and exemptions. Double-check the data to avoid mistakes.

Verification and Submission

After filling in the form, verify the details and submit it online or offline, as per your chosen method.

Acknowledgment

Once submitted, you'll receive an acknowledgment receipt. Keep it safe, as it serves as proof of filing.

Copyrights © 2021 Aasian Group . All rights reserved. Designed By AbtusWorld.com