Goods and Services Tax (GST)

Introduction

The Goods and Services Tax (GST) has been hotly debated in recent years, and is an important component of existing tax systems around the world. In this essay, we will look at several features of GST, such as its definition, history, benefits, drawbacks and application in different countries.

What is Goods and Services Tax (GST)?

GST is a sales tax applied on the purchase of goods and services. Unlike previous tax systems, which imposed multiple taxes at different stages of production and distribution, GST aims to simplify the taxation process by integrating multiple taxes into a comprehensive system. It is essentially a value added tax that collects tax on the value added at each stage of the supply chain.

History of GST

The concept of GST can be dated back to the early nineteenth century, although it acquired traction in the late twentieth century. In 1991, Canada became one of the first countries to implement a GST system. Since then, numerous countries have adopted this taxing approach to simplify their tax systems and encourage economic growth.

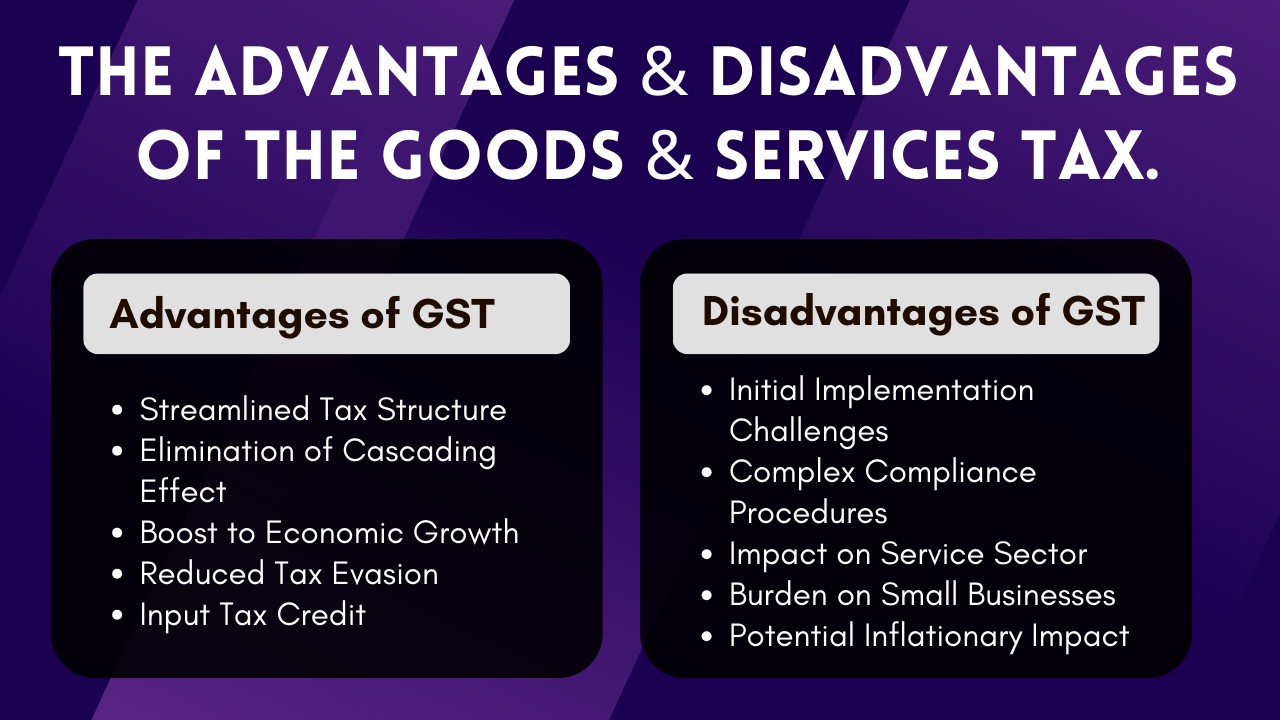

Advantages of GST

1. Simplification:

GST reduces the complexity of the tax structure, making it easier for businesses to comply with tax regulations.

2. Elimination of Cascading Taxes:

With GST, taxes are only paid on the value added, preventing the taxation of taxes.

3. Boost to Economic Growth:

By encouraging consumption and investment, GST can stimulate economic growth.

Disadvantages of GST

1. Transition Challenges:

Switching to a GST system can be challenging for businesses, and it may take time to adapt.

2. Impact on Small Businesses:

Smaller enterprises may face difficulties in compliance and may need additional support.

3. Vulnerable to Tax Evasion:

Proper enforcement and compliance are crucial to prevent tax evasion.

Implementation of GST in Different Countries

GST is applied in numerous ways across the world. To meet its economic and social needs, each country has its own GST structure and laws. Australia, Malaysia, and Singapore, for example, have GST, whereas the European Union has a comparable value-added tax (VAT) system.

GST in India

GST Council

GST was implemented in India in 2017, and it is governed by the GST Council, which includes representatives from both the central and state governments. The GST Council is in charge of making critical decisions about GST rates and rules.

GST Rates

GST is divided into five tax slabs in India, ranging from 0% to 28%. Food and medication are normally taxed at lower rates, whereas luxury items are taxed at higher rates.

GST Registration

Businesses with a taxable turnover of more than a particular amount are required to register for GST. This guarantees that they follow tax requirements and appropriately disclose their transactions.

GST Return Filing

Businesses must file GST returns on a regular basis. This procedure assists the government in efficiently monitoring transactions and collecting taxes.

Impact of GST on Various Sectors

GST has had varying effects on various sectors in India. While some have benefited from lower tax loads, others have encountered difficulties in adapting to the new tax structure.

GST Compliance and Enforcement

Ensuring GST compliance is critical for both businesses and the government. To deter tax evasion and protect tax integrity, strong enforcement tools are in place.

GST vs. Other Tax Systems

GST is frequently contrasted with other tax systems, such as sales tax and service tax. Understanding the fundamental distinctions is critical for both organizations and consumers.

GST and Small Businesses

Small businesses are critical to the economy. The impact of GST on them and the assistance available to assist them in adapting is a significant concern.

Global Perspective on GST

Understanding how GST is handled and managed in different nations provides significant insights into the taxing model's flexibility.

The Future of GST

The taxation world is always changing. GST's future will continue to adapt to meet new problems as technology and economies change.

Conclusion

The Goods and Services Tax is an important step toward reforming tax systems around the world. While it has its drawbacks, the benefits of a streamlined, consumption-based tax system are obvious. GST benefits not only governments, but also consumers and businesses by streamlining the taxes procedure.

Copyrights © 2021 Aasian Group . All rights reserved. Designed By AbtusWorld.com